Question: We have heard that there is a new law about winter tires. Tires now need to have the snow flake symbol on them or insurance will not cover us for a crash. Is this true?

Question: We have heard that there is a new law about winter tires. Tires now need to have the snow flake symbol on them or insurance will not cover us for a crash. Is this true?

Answer

I asked ICBC about situations like this before the new Enhanced Care scheme was implemented. The response was that not using winter tires when required to do so would not void your insurance coverage.

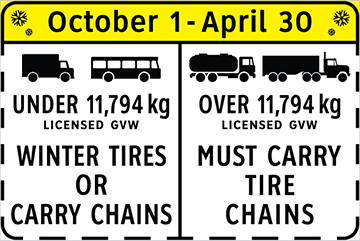

Law on Winter Tires

Section 208 MVA requires that vehicles must be equipped with winter tires when the Minister gives public notice or posts signs to that effect.

What makes a tire a winter tire is defined in Division 7.162 MVAR.

Contributory Negligence

Under the Negligence Act, if the court finds that you contributed to the collision by not having winter tires on your vehicle your award for damages could be reduced in proportion to your fault.

How this would operate under the new insurance scheme remains to be scene, but a quote from one BC injury lawyer firm states that:

Contributory negligence is a legal defence that ICBC uses to reduce an injured claimant's compensation. The argument behind contributory negligence is that the injured claimant failed to take reasonable care for his/her own safety and that this contributed to the injuries suffered in a motor vehicle accident.

Share This Article

? " ...... the courts will find liability on your part if a crash occurs and this might reduce the amount that you receive for damages...."

The question was basically, "If I don't have the correct, legal tires on my vehicle will I have insurance ?"

For starters, even if there was a breach in the Insurance Vehicle Regs that said, "if you don't have legal tires, your insurance will be void", it would have to pertain to a situation where the lack of the proper tires caused the accident.

However there is nothing in your insurance that voids coverage for lack of tires.

Also, if you are in a collision, where you are at fault, you won't receive damages anyway. You will receive medical and wage loss, which WILL NOT be reduced. It wouldn't even be reduced if you were drunk. It's called NO FAULT, about the only thing you can do to breach it is to lie to ICBC. If you have Own Damage coverage with ICBC your vehicle will also be covered.

The statement "might reduce the amount that you receive for damages" would only apply in a "contributory negligence" situation. You see it mostly when someone is not responsible for a loss, but was injured and that injury was exacerbated by the lack of use of a seat belt for example.

If you can figure out how you could not be at fault for a collision, BUT your lack of use of proper snow tires exacerbated your injuries you've found the situation.

And, no, getting stuck in the snow and then being hit by another vehicle wouldn't qualify.

I know people who could get stuck in the snow driving a snow cat.

ICBC insures stupidity, thus, yes, they will cover you with your bald summer tires on the Coquihalla in February.

That would be like saying, if you were driving to work when you only had pleasure insurance on your vehicle and were hit by a car going through a red light you're partially at fault because if you had followed the restriction on your insurance you wouldn't have been driving. WRONG.

Lack of proper tires is a violation, for sure, but it doesn't breach your insurance, just like having an accident after breaking all sorts of laws doesn't breach your coverage. Can you imagine the number of unpaid claims, if ICBC only covered drivers who hadn't committed a Motor Vehicle Act violation ? Go through a red light and crash, yes, you are at fault, but covered.

Criminal acts, a whole other ball game.

- Log in to post comments

- Log in to post comments

? " ...... the courts will