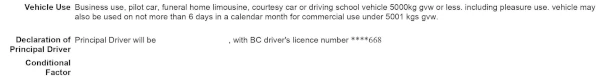

When you apply for vehicle insurance with ICBC you are asked who the principal driver will be. This is the person that will be driving that vehicle the majority of the time during the term of the policy. An important factor in setting the premium for the policy is the driving history of this person.

When you apply for vehicle insurance with ICBC you are asked who the principal driver will be. This is the person that will be driving that vehicle the majority of the time during the term of the policy. An important factor in setting the premium for the policy is the driving history of this person.

Falsely Declaring the Principal Driver

You might be tempted to declare someone as the principal driver when they are not in order to save money on the premium. One of the most common situations is where a parent declares themselves as the principal driver of a car purchased to be driven by their children.

This is a very risky thing to do. In the event of a crash you could be found to be in breach of your insurance policy contract with ICBC. You would then be held personally responsible for the payment of the costs of injury or property damage caused in the crash. These costs could be huge.

Case Law Example of Misrepresentation

The case of Deters v Totovic is an example of this situation.

Tamara Totovic was driving a car owned by her mother, Smilja Totovic. She caused a collision by driving into the rear of a car operated by Corrina Deters. ICBC took legal action against Ms. Totovic for declaring herself as the principal driver when it should have been her daughter. Had she have done so, the premium would have been significantly higher due to Tamara's driving record.

At trial, Justice Smith heard evidence that Tamara used the car for work.

Testimony from her employer contradicted her assertion that she used transit for her job duties. Items in the vehicle noted by the ICBC claims examiner were related to her work. Records held by the Superintendent of Motor Vehicles showed that she was driving the car when she had received a speeding ticket and a 24 hour suspension.

The justice decided that at the time the policy was issued, Ms. Totovic must have known that her daughter was the principal operator of the car. On the balance of probabilities she made a misrepresentation when she declared herself to be the principal driver.

The cost of the collision was not specified in the judgment.

Learn More

Share This Article

- Log in to post comments

Comments

Of course if we had a real insurance company they would insure the drivers, and not each vehicle. Charge an annual license fee on each vehicle and insure each driver accordingly.

- Log in to post comments

Insure the Driver, Not the Vehicle